Introduction

Accounts Payable (AP) and Accounts Receivable (AR) are fundamental elements of financial management in any organization. These accounting functions play a crucial role in managing cash flow, maintaining financial stability, and ensuring operational efficiency.

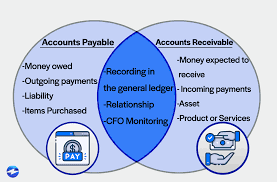

While AP focuses on managing what the company owes, AR deals with the money owed to the company.

Accounts Payable: Managing What We Owe

Accounts Payable represents the total amount of money a company owes to its suppliers and creditors for goods and services received but not yet paid for. Efficient management of AP ensures that a company maintains good relationships with its suppliers and avoids late payment penalties.

Process Overview

- Invoice Receipt and Verification: The AP process begins with receiving invoices from suppliers. These invoices must be verified for accuracy, matching them against purchase orders and receiving reports to ensure that the goods or services were actually delivered.

- Approval and Payment: After verification, invoices are routed for approval. Once approved, payments are scheduled based on the agreed terms with suppliers. Timely payments help in taking advantage of early payment discounts and maintaining good vendor relationships.

- Record Keeping: AP transactions are recorded in the accounting system, and records are maintained for auditing purposes and future reference.

Challenges in Accounts Payable

- Late Payments: Failure to manage payment schedules effectively can result in late fees and damaged relationships with suppliers.

- Fraud Risk: Inaccurate invoice processing or unauthorized payments pose risks of financial fraud. Implementing strong internal controls can mitigate these risks.

Accounts Receivable: Managing What We Are Owed

Accounts Receivable refers to the money that customers owe a company for goods or services provided on credit. Effective management of AR is crucial for maintaining liquidity and ensuring that the company has sufficient cash flow to meet its obligations.

Process Overview

- Invoicing: After delivering goods or services, companies issue invoices to customers. These invoices detail the amount owed, payment terms, and due date.

- Collections: Monitoring outstanding invoices and following up with customers to ensure timely payment is a key function. Companies may employ various strategies, including reminders and collection agencies, to manage overdue accounts.

- Record Keeping: AR transactions are recorded to track customer payments, outstanding balances, and aging of receivables. Accurate records help in forecasting cash flow and assessing credit risk.

Challenges in Accounts Receivable

- Delinquent Accounts: Late or non-payment by customers can impact cash flow and increase the risk of bad debt. Implementing credit policies and performing regular credit checks can help manage this risk.

- Dispute Resolution: Discrepancies or disputes over invoices can delay payments. Efficient resolution processes and clear communication with customers are essential for managing such issues.

The Interplay Between Accounts Payable and Accounts Receivable

AP and AR are interconnected aspects of financial management. Effective management of AR ensures that the company has the cash inflows needed to meet its AP obligations. Conversely, managing AP efficiently helps avoid liquidity issues that could affect the company’s ability to collect receivables.

Cash Flow Management: Balancing AP and AR is crucial for maintaining a positive cash flow. Companies need to ensure that the timing of payments and collections is aligned to meet their financial obligations without straining their cash reserves.

Financial Reporting and Analysis: Regular analysis of AP and AR data provides insights into the company’s financial health, including cash flow trends, credit risk, and operational efficiency. This analysis supports strategic decision-making and financial planning.

Conclusion

Accounts Payable and Accounts Receivable are critical functions in financial management that ensure the smooth operation of a business’s cash flow. Effective management of AP and AR helps maintain healthy supplier relationships, optimize cash flow, and enhance overall financial stability. By understanding and addressing the challenges associated with these functions, companies can improve their financial performance and achieve long-term success.